Cme bitcoin futures trading

Conținutul

Bitcoin is officially a commodity, according to U. So says the Commodity Futures Trading Commission CFTCwhich on Thursday announced it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform.

While market participants have long discussed whether Bitcoin could be defined as a commodity, and cme bitcoin futures trading CFTC has long pondered whether the cryptocurrency falls under its jurisdiction, the implications of this move are potentially numerous. In the event of wrongdoing, such as futures manipulation, the CFTC will be able to bring charges against bad actors.

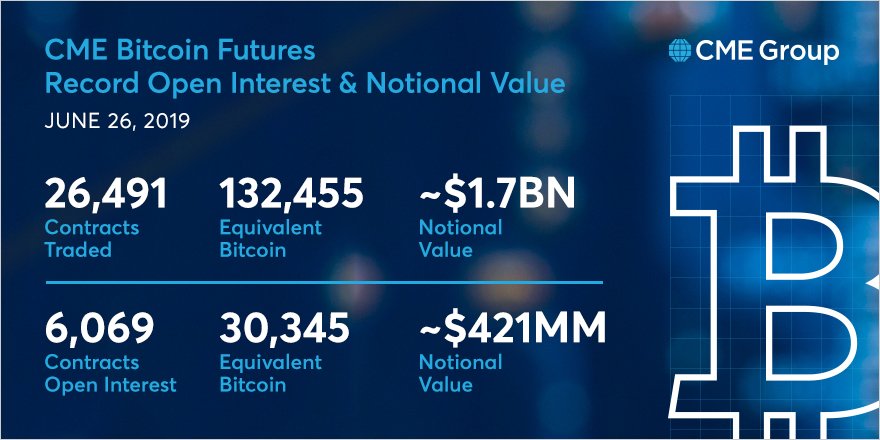

If a company wants to operate a trading platform for Bitcoin derivatives or futures, it will need to register as a swap execution facility or designated contract market, just like the CME Group. And Coinflip—the target of the CFTC action—is hardly the only company that provides a platform to trade Bitcoin derivatives or futures. The U. That means the regulator can now bring charges against any wrongdoers trading cryptocurrency futures and options.

Bloomberg asked leading members of the bitcoin community for their views. There are so many regulators in the U. Last year, the U. Last month a Japanese judge ruled that Bitcoin is not property.

These rulings concerning what Bitcoin is or is not are for certain purposes only, but they often get taken out of context.

However a lot of the value proposition of Bitcoin is tied up in the non-compliance aspect.

With the cost of compliance can companies stay competitive? Din aceeași categorie 25 iunie Biometrie 25 iunie